Fiat currency is a global bubble waiting to pop

My intention is not to cause panic or outrage but to get people to question where they store their energy. More specifically, I hope this helps you and your family take action to become more secure and financially bulletproof. I’ll conclude by offering some resources and actions worth considering—money for people in a hurry.

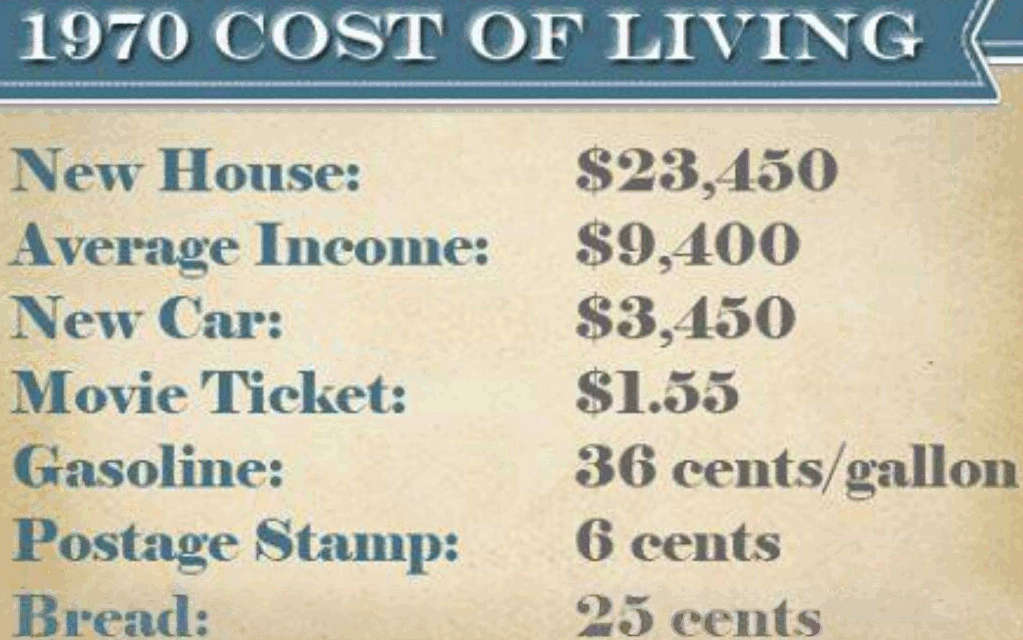

- Inflation is a tax on savings caused mainly by government spending. One may also say it’s criminalizing people for saving. Unfortunately, only poor people save.

- Gold was confiscated from citizens under FDR (probably the worst president ever!). This was called Executive Order 6102 and was extremely controversial as some thought it’d spark a civil war.

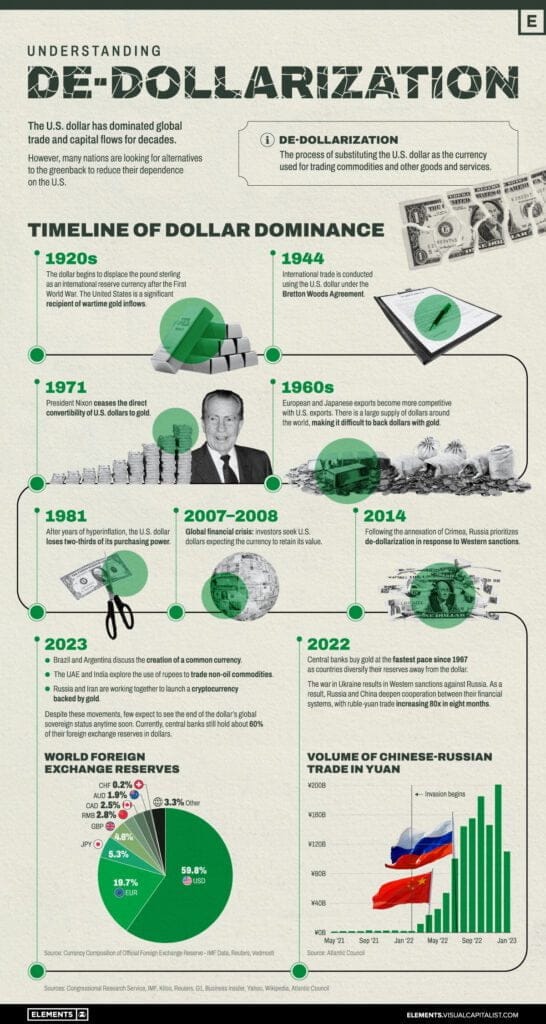

- Decades later Nixon officially put to rest the practice of dollars being backed by gold. $100 no longer needed to have $100 worth of gold in existence.

- Having fiat money redeemable and pegged to something hard to produce (gold, silver, or BTC) stabilizes the economy by actively regulating fraudulent activity.

- If you look back, gold pegged to money reduced inflation, uncertainty, and the size and power of government. Some will even argue it reduced the incentives of monetizing war which is worth looking into.

- Fiat pegged to a scarce and hard-to-produce asset increases savings, entrepreneurship, allocation of time, and effort in providing real value.

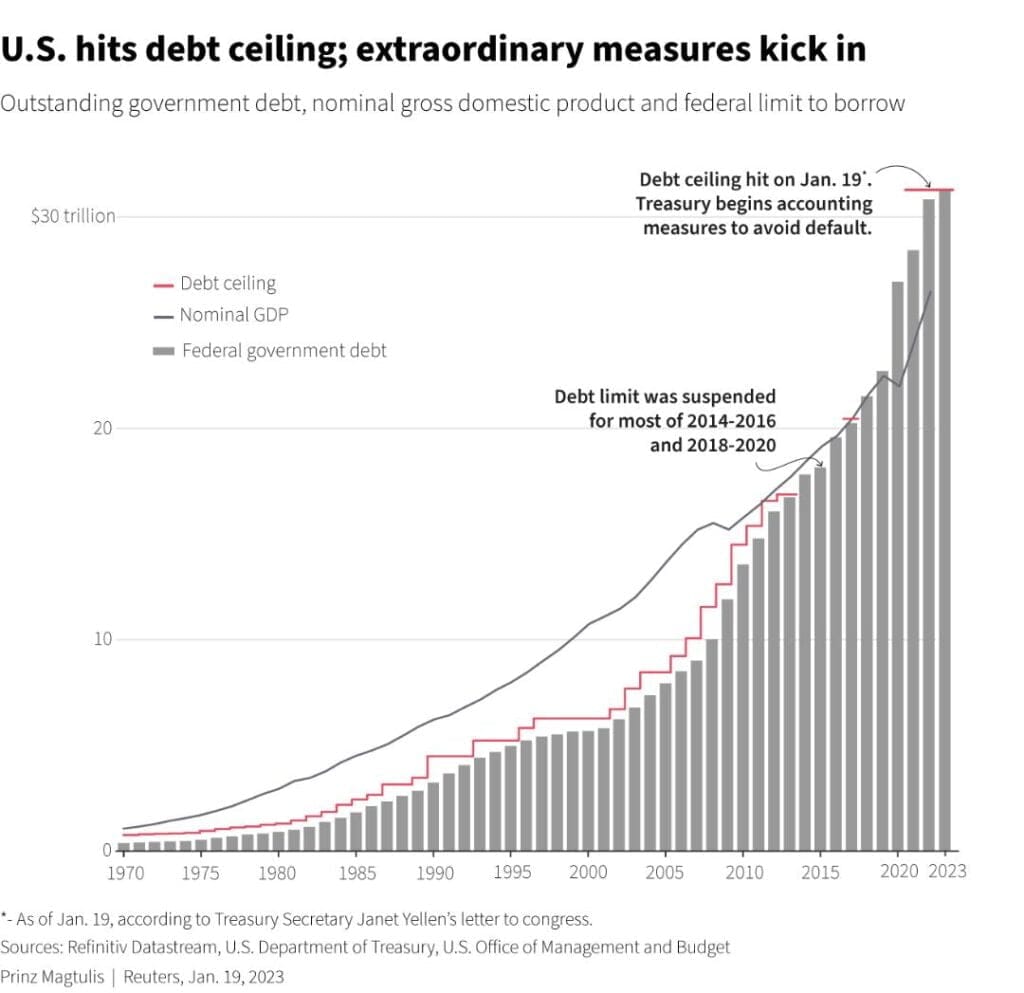

- Today, banks only keep 10% of our deposits available and lend out the rest creating a bubble economy. If we all went to our banks at the same time, they’d fail. There are more IOUs in existence than actual money.

- Money backed by nothing leads to dysfunction. When the US ended the gold standard this made the money a pyramid scheme, the economy a bubble, future generations vulnerable, and most people unable to climb the social ladder.

- Because fiat is easily created and backed by nothing, it encourages cheaply produced goods and services to flood the market. This is due to the rate at which new money is printed or inflated creating desperation. People respond by doing things to survive, not for the love of the craft. Hence, the dilution of almost everything today. Food, music, movies, architecture, etc.

- Fiat overproduces lies, corruption, etc. for the same reasons. Taking your time to carefully produce something of value is a privilege most people can’t afford.

- Lies sell faster than truth & clickbait sells faster than journalism. Just ask Julian Assange.

- Another example of this is the food industry. The motto is “Put corn and refined sugar in everything”.

- Centrally controlled money by “man” will inevitably come to be:

- Biased – all humans are biased, bankers and governments too.

- Censored – accounts are seized or frozen if you pose a threat to the controlling power.

- Weaponized – used to exploit and conquer.

- Coercive – backed by force.

- For money to work, it must hold properties that allow people to rely on it. Give or take, it should hold the means of durability, portability, fungibility, divisibility, scarcity, and censorship resistance.

- Inflation is not a naturally occurring phenomenon. As production becomes more efficient via technological advancements, if not manipulated, it will drive prices down.

- Societies that had inefficient or bad money had their wealth extracted or stolen and were forced into slavery by outsiders. For example, with bad money, we see the use of beads in parts of Africa made Africans vulnerable to the Europeans. The Europeans replicated the beads extracting their wealth. This indebted them and contributed to slavery (link below on this history). Then with inefficient (backed by nothing) money today we see there is still mass slavery today. Legally and illegally.

- By staying invested in the monetary system we must take responsibility for funding war, exploitation, and violence everywhere. Money is the second most weaponized tool available.

- Debt-based money creates imaginary realities and enslaves our future.

- Historically, all currencies have failed. To read the outcome of a currency “dying” check out When Money Dies by Antony Ferguson. It’s a vivid history of Weimar Germany’s experience.

Again, my intention is for you and your family to consider whatever you believe is best for you to make sure you’re secure. If you want to divert from this pervasive germ of a system here are some tangible steps:

- Educate yourself.

- Eat foods with regenerative farming labels and grass-fed products.

- Avoid unhealthy foods.

- Avoid propaganda and toxicity.

- Look into assets that do well in times of uncertainty.

- Consider how your actions affect the immediate and larger ecosystem. We are all connected.

These are just some suggestions. It’s a way to send communication to the market. Not all protests require a physical presence. Sometimes existing or love is the most revolutionary act. This critique is made with promise for a truthful future.

Educational website:

What Has Government Done to Our Money? | Mises Institute

Books:

Economics in One Lesson -Henry Hazlit

Principles of Economics – Saifedean Ammous

Debt – David Graeber

When Money Dies – Antony Ferguson

Articles:

History of Beads in Africa: An Overview — The Bead Chest

History of Trade Beads

The Unique Symbolic Power of Trade Beads | Atlas Accessories

What Does Russia’s Removal From SWIFT Mean For the Future of Global Commerce? – Foreign Policy

Fractional Reserve Banking: What It Is and How It Works (investopedia.com)

Youtube:

How The Economic Machine Works by Ray Dalio

Documentary:

Kiss the Ground (Netflix)