The Perils of Inflation

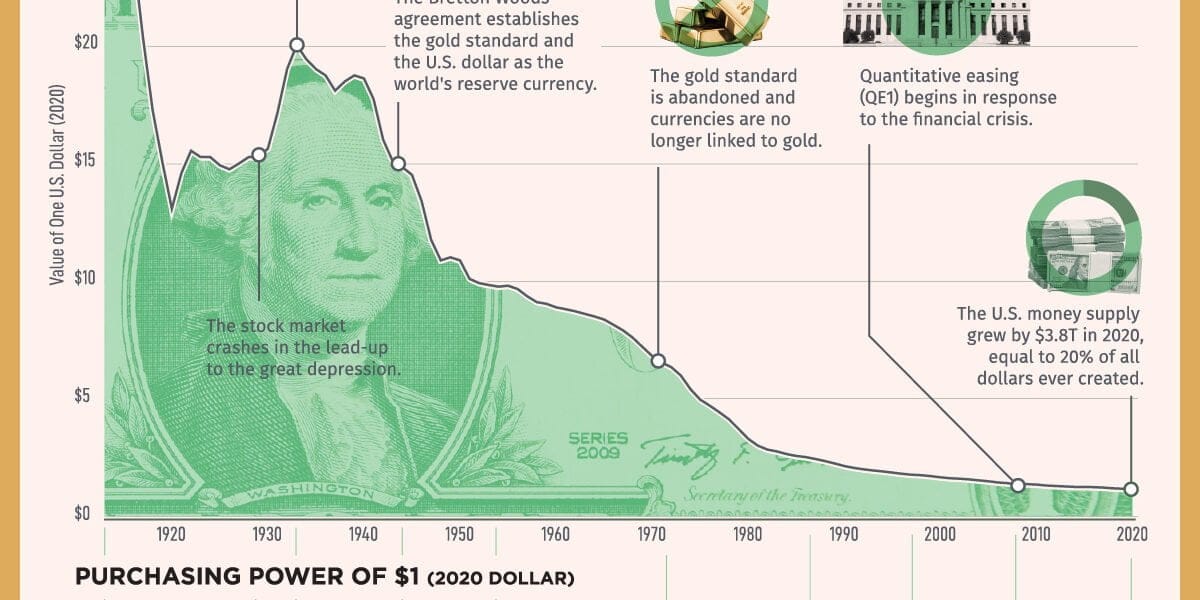

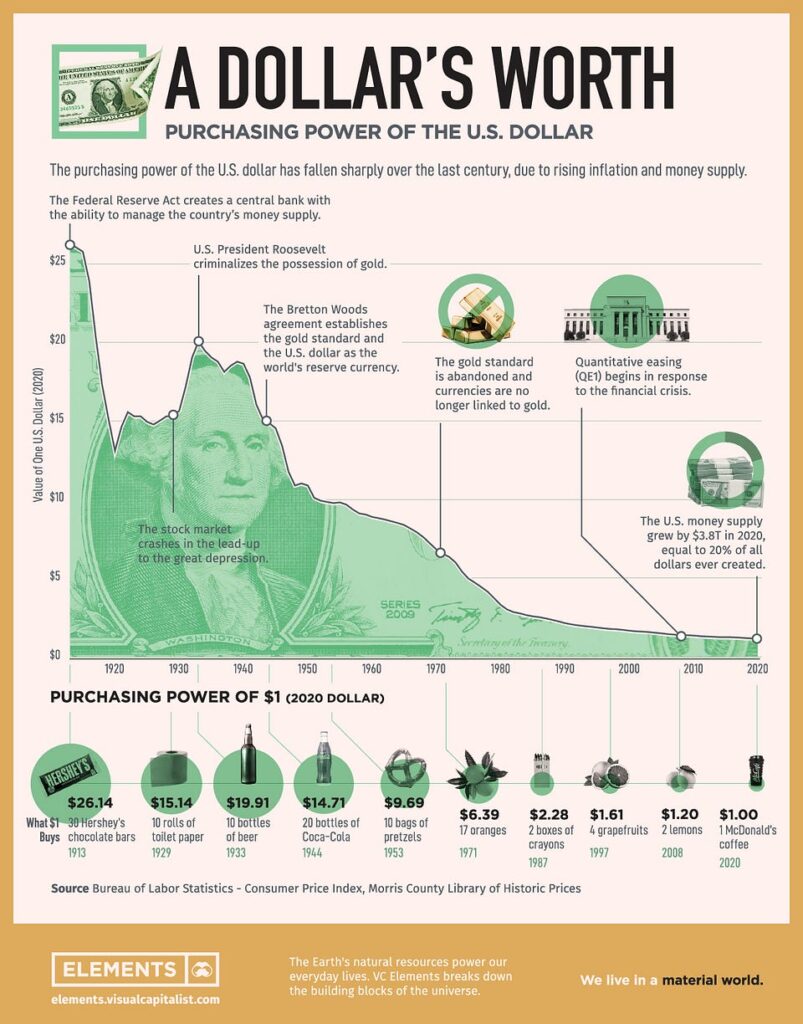

Under a centrally planned monetary system that engineers inflation into an economy, man-made disasters, and corruption are inevitable. Fellow citizens are left to unhealthily compete against one another as the average person struggles to stay afloat. Overnight, purchasing power is incontestably diluted as the existing monetary supply increases, watering down the previous potency, or flow in existence.

The citizens most vulnerable to such attacks are people with no assets. As a result, this pervasive tactic hits them like a natural disaster wiping away the production of their labor.

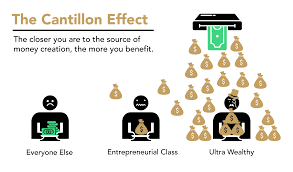

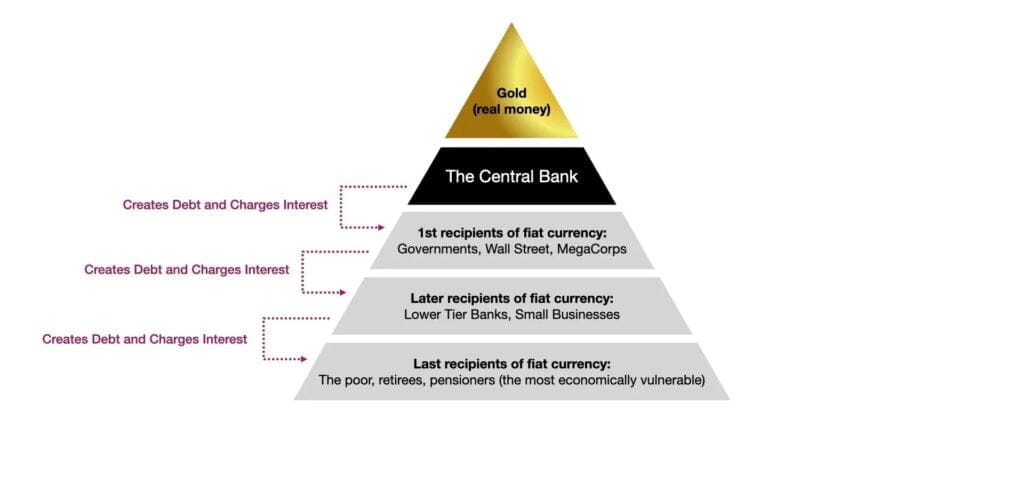

Those better positioned with products or services may temporarily benefit if they sell or adjust their business(es). This is represented under the Cantillon Effect. We can see those closest to the incoming supply of money can spend first before markets adjust. Inflation is simply the redistribution (or stealing some may argue) of your funds to the government. A hidden tax so they don’t default.

Most pundits foolishly want to ponder on how the rich get richer and conclude it’s a result of anything except for how money comes into existence in the first place. The rich get richer for many reasons, but it is largely because they hold too many assets to fail. They can endure the inflationary attack as opposed to other countries where you can literally see people with stacks of money being transported on wheelbarrows to purchase basic things like bread.

Consider the pressure that the circulation of new money printed into the economy puts on the average person, ironically, to spend their money faster. Saving becomes detrimental in their mind as things become more expensive around them. However, by not acquiring assets it is like not taking precautions during hurricane season in a high-risk territory.

This influences the relationship the average person has with money long-term. Inflation communicates that they should spend their money before it’s taken away. Money becomes villanized in their mind and as something not to aspire to earn. Such thinking leads to Marxism and the rise of conspiracy theories. This happens because reality is rigged and theories are the only way to make sense of the madness.

On the other hand, for someone in the proximity of the freshly printed dollars (politicians), or with assets, inflation wiping out “the little guys” offers them an opportunity. With capital at their disposal, they come off the bench to play. We see this in industries and markets. Those with assets, accumulate more assets, but now for a discount from those forced to sell. Despairing times influence most people to sell immediately. Worst, is that they often buy back in later on, missing their opportunity. This miscalculation gets lost in the media and creates animosity towards “them”. In reality, this is not the fault of people with assets who are often criticized as a scapegoat, but instead the fault of The Fed and government for engineering the inflation.

The struggle to withstand inflationary attacks simultaneously restricts our ability to obtain education on what’s happening because our time is devalued. This forces us to work more, tiring us out, and so we seek entertainment over education as a form of coping. As a result, we’re forced to rely on biased pundits that never get to the root cause but rather rely on pointing the finger solving nothing. Some media people will even exploit the public, feeding into the “us vs them” rhetoric, building tension, and fragmenting society to get your mind off the money being the root issue. This equation further feeds the system, giving it strength by keeping it hidden in plain sight.

Even though the price of the dollar impacts America directly, this reallocation of wealth is ubiquitous. It is impairing to all country-people. In fact, with the dollar being the world’s reserve currency most other currencies will often deflate even more volatile. Wealth under globalization is something shared amongst all organisms. Therefore, an attack on wealth hurts all life. The entire ecosystem is harmed as time, energy, truth, and resources are distorted.

Our monetary system is propagandized as “normal” and even “natural”. However, it must be properly identified as being anti-capitalist. You can’t have a free market with centrally planned money. Human prejudices will inevitably lead to the system we must deal with today. In which our time and energy are technologically extracted at will. Additionally, it creates a fraudulent price of all things, leading to a world of delusion and scarcity, which further leads to mass exploitation and the pillaging of an otherwise naturally abundant Earth. Holistically, this phenomenon negatively impacts everything directly or indirectly, rotting our future.

Currently, we incorrectly see wealth as money and money as a race in which we compete to “get ours”, securing our share first by any means; and there’s a limited amount the further down you are systemically. In my mind, there are only two options to solve the money problem and all issues that derive from its flaws. One is to politically pressure those in power (the fed), demanding money backed by gold, as it was until Nixon took us off the gold standard in 1971 (WTF Happened In 1971?). The other option is to adopt a fully decentralized and extremely secure digital currency, notably Bitcoin.

Additional resources:

Documentary: “The Money Masters” 1996. This is a great documentary on America’s long battle against central bankers and the removal of the gold standard.

Books: #ad The Fiat Standard, The Price of Tomorrow

Interview: Avoid The Dollar Crisis